By: Amit Gupta

الفئات

Submit an application for Osla Student education loans 2022 for the Us (U.S.) See Status

OSLA Student education loans is one of the lesser government financing features on the market. The latest Oklahoma Education loan Power, otherwise OSLA, is a beneficial nonprofit place, created in the year 1972 from the county from Oklahoma, and sustains alone through its own cash.

Simple tips to Submit an application for a student loan

Their office was discover for all individuals to go to from inside the week, and that differs from new mega-servicers eg Navient or Nelnet, that do not advertise within the-people check outs.

OSLA’s first company originates from servicing government student education loans. After the year 2009, it got maintained $step one.6 mil of student loans.

In terms of quality of service, OSLA enjoys not too many in public released grievances. Truly, this can be quite refreshing as the plenty of features has actually a huge selection of issues released online.

If it is because OSLA’s small size otherwise because are a premier-high quality servicer isnt clear. It can be a combination of both.

Just how to Refinance My OSLA Student loans

You can re-finance your OSLA college loans if you take out a great the fresh new loan that have a personal lender to settle your current loans. Refinancing is amongst the two methods for you to key financing servicers while you are unhappy that have OSLA.

However, may possibly not end up being your best bet. That’s because might treat multiple trick masters that can come which have federal finance.

If you aren’t happy with OSLA, consider taking out a federal Head Integration Loan instead. It mortgage enables you to switch attributes when you’re however enjoying the advantages that include government loans.

How to avoid The most common which have OSLA

OSLA produces apparently few grievances versus other federal financing servicers by . Merely twenty-seven customers features registered complaints to your Individual Financial Safety Bureau (CFPB).

Additionally, it produces a the+ towards the Better business bureau (BBB) considering products eg amount of time in team and now have openness.

- ServisFirst Lender Greatest Viewable and you may Techniques

- Earliest Financial Troy Nc, Individual Banking and you may Business Financing

- Owners Basic Financial new Communities Consumer Book for simple Financial

step one. Badly canned payments

? How to prevent they: Because the OSLA’s webpages does not promote much information on how to pay out of the loan or make early payments, get in touch with support service to have specific tips.

Look at your membership following the percentage knowledge to ensure they used it your expected, and touch base immediately if you see anything incorrect.

2. Wrong recommendations stated in order to credit bureaus

That debtor told you OSLA said the loans since the outstanding once they was into the forbearance. Facts about similar grievances is also not available toward societal.

And make a practice off on a regular basis checking your own credit reports. Also, to be sure not one of your creditors is actually improperly revealing their payments. Get in touch with OSLA if you see problems getting them enhance the brand new situation.

Faq’s

Here are some methods for you to solve your trouble. Also, a leader for the education loan refinancing, can help you within the refinancing the funds and purchasing him or her regarding reduced. Start today.

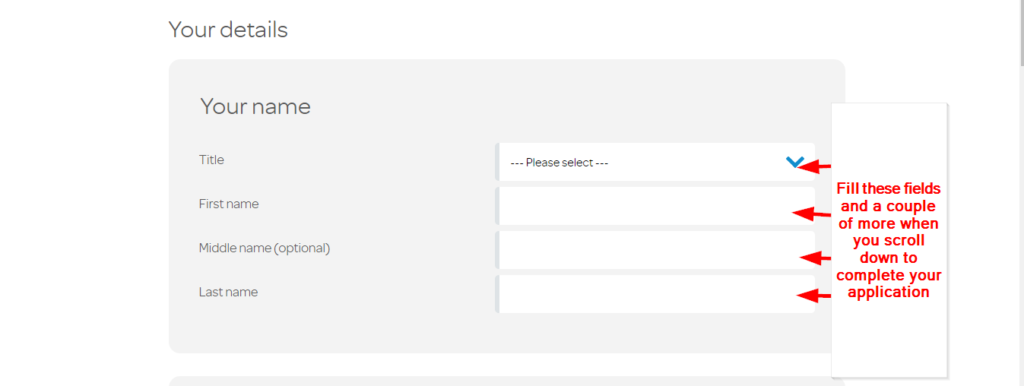

Over and you can upload an application to help you OSLA. The type of mode you prefer hinges on the type of cost bundle you are interested in. Specific preparations want a lot more documentation.

Look at your account matter. Lead financing membership numbers start with both an enthusiastic F otherwise 8 and tend to be followed by 9 wide variety cash till pay day loans. FFELP money start out with a 0, accompanied by seven numbers.

You can repay the loan very early playing with some of OSLA’s percentage options. not, attempt to get on your on line account otherwise contact support service to find out simple tips to identify ways you’d like OSLA to apply the more money.

How you will pay off the loan having OSLA hinges on the new brand of loan you may have. When you’re a keen FFELP mortgage holder.

Oklahoma Education loan Authority (OSLA) are a federal mortgage servicer that’s caused new Company from Training for more than 40 years.

It’s got among the many lower ailment costs one of government loan servicers. However, you might need customer service if you are looking for more compared to earliest information it provides on the internet.

What’s your own deal with so it? We feel this article is actually interesting correct, if yes, please play with our very own share switch less than to share with members of the family and relations thru Facebook, and Myspace.